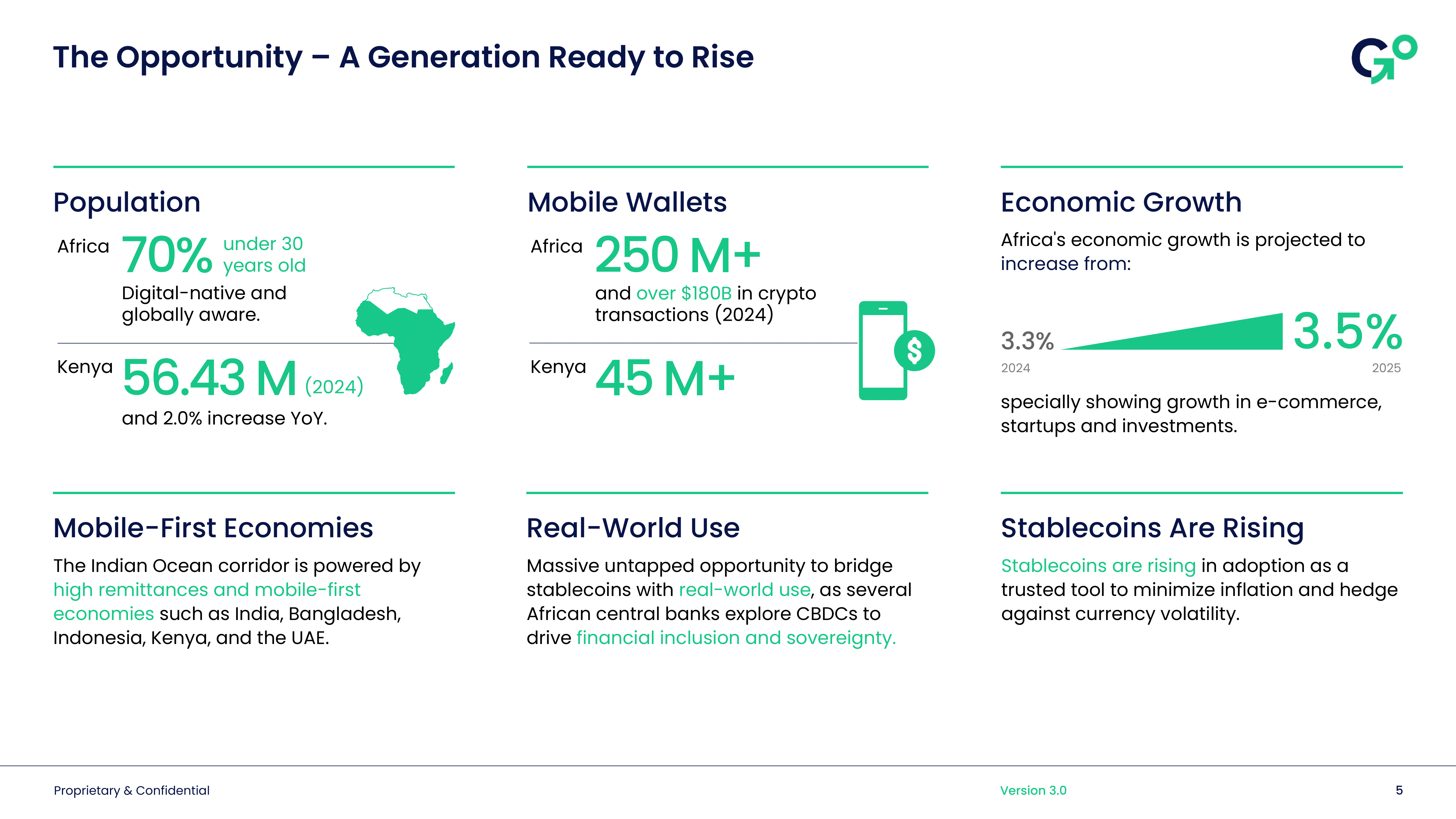

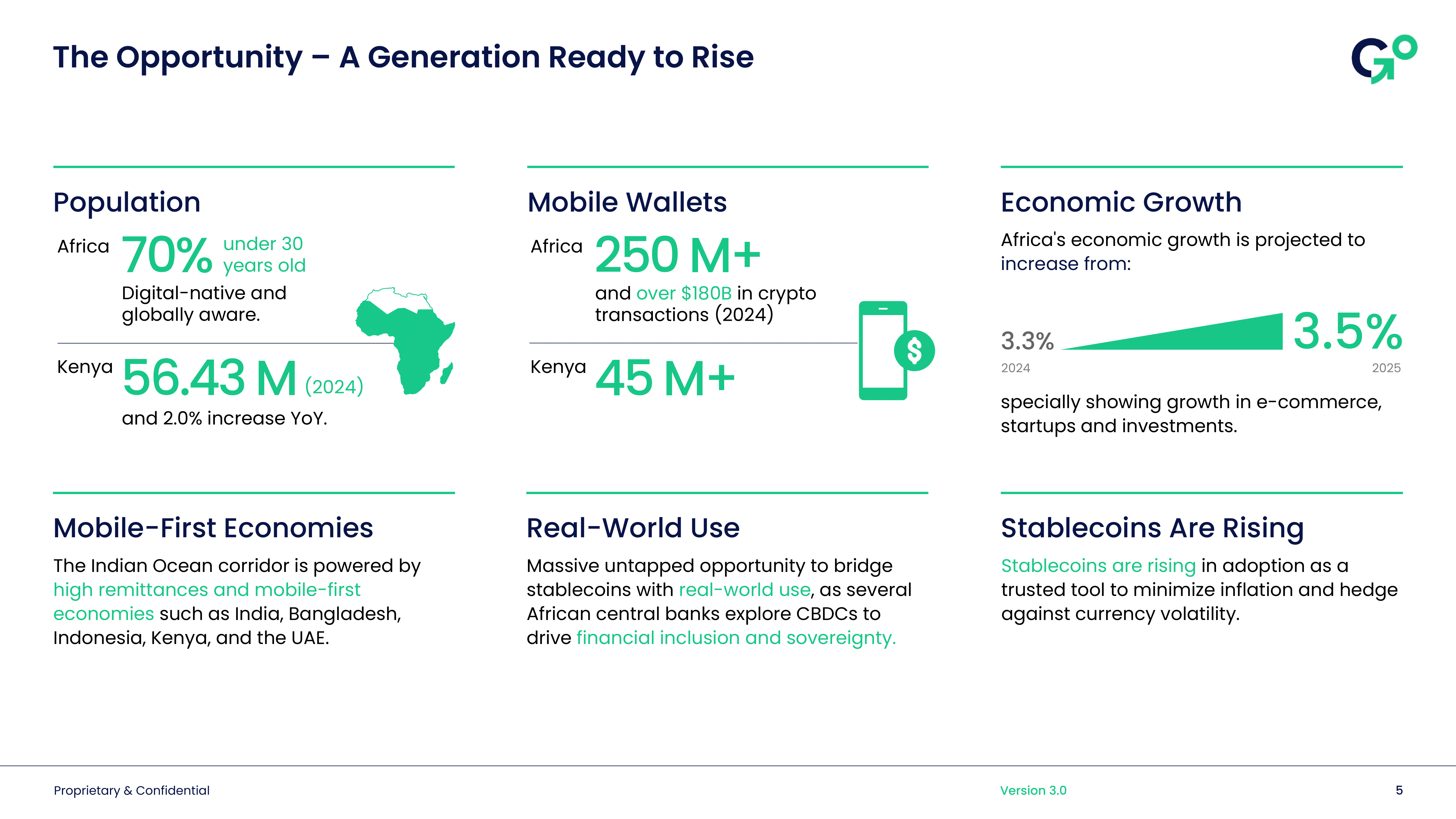

The Opportunity – A Generation Ready to Rise

The African continent presents an unprecedented opportunity for financial innovation, driven by a young, digitally-native population and rapidly evolving mobile-first economies.

Population Dynamics

Africa's Youth Advantage

- 70% under 30 years old - digital-native and globally aware

- Kenya 56.43M (2024) with 2.0% increase YoY

- This demographic represents the largest untapped market for financial services

Mobile Wallets & Digital Adoption

Current Market Size

- Africa 250M+ mobile wallet users

- Over $180B in crypto transactions (2024)

- Kenya 45M+ mobile wallet users

Mobile-First Economies

The Indian Ocean corridor is powered by high remittances and mobile-first economies such as:

- India

- Bangladesh

- Indonesia

- Kenya

- UAE

Economic Growth Projections

Regional Economic Outlook

- Africa's economic growth projected to increase from:

- 3.3% (2024) to 3.5% (2025)

- Key growth sectors:

- E-commerce

- Startups

- Investments

Real-World Use Cases

Untapped Potential

Massive untapped opportunity to bridge stablecoins with real-world use, as several African central banks explore CBDCs to drive:

- Financial inclusion

- Sovereignty

Stablecoin Adoption

Stablecoins are rising in adoption as a trusted tool to:

- Minimize inflation

- Hedge against currency volatility

Strategic Market Position

Target Demographics

- Mobile-first users who prefer digital solutions

- Community-driven finance participants (Chamas)

- Cross-border workers and freelancers

- Remittance senders and receivers

Market Characteristics

- High remittance flows ($100B+ annually)

- Large unbanked populations

- Increasing crypto engagement

- Strong community financial networks

The Indian Ocean Corridor

Global Reach

This corridor represents:

- Over 3 billion people (40% of the global population)

- $100B+ in annual remittances

- One of the most strategic frontiers for Web3 adoption

Regional Integration

- Harmonized regulations through regional blocs

- Strong intra-regional trade

- Rising demand for decentralized financial tools

Why Now?

Perfect Storm of Factors

- Demographic dividend - young, tech-savvy population

- Mobile penetration - widespread smartphone adoption

- Regulatory evolution - governments exploring digital currencies

- Community finance - existing strong Chama networks

- Cross-border needs - high remittance volumes

- Crypto adoption - growing acceptance of digital assets

Timing Advantage

- Early mover advantage in regulated crypto-fiat bridges

- First-mover status in community-based DeFi

- Regulatory sandbox opportunities

- Growing institutional interest in African fintech

Market Validation

Existing Infrastructure

- M-Pesa ecosystem with 45M+ users in Kenya

- 300K+ Chamas managing $3.4B+ in assets

- Established mobile money networks across East Africa

- Growing crypto adoption in urban centers

User Behavior

- Preference for mobile over traditional banking

- Community-based decision making

- Trust in local networks over global platforms

- High remittance frequency and volume

This convergence of factors creates an unprecedented opportunity for GoChapaa to build the financial operating system for the next generation of emerging market users.