Strategic Growth Corridor

GoChapaa's expansion strategy follows a carefully planned geographic progression that leverages regional synergies, regulatory harmonization, and cultural similarities to build a comprehensive financial ecosystem across the Indian Ocean corridor.

Phase 1: Kenya

Market Characteristics

- Deep-rooted mobile money culture (M-Pesa with 45M+ users)

- Strong grassroots financial networks (300K+ Chamas managing $3.4B+)

- Early stablecoin adoption and crypto awareness

- Technical talent hub attracting top developers

Nairobi as Fintech Hub

- Africa's answer to Dubai or Singapore for fintech innovation

- Rapidly positioning as a frontier fintech hub

- Attracting top technical talent and early adopters

- Regulatory sandbox environment for innovation

Strategic Advantages

- Proven mobile money infrastructure and user behavior

- Existing agent networks for physical presence

- Regulatory framework for crypto and fintech

- Local talent pool with relevant experience

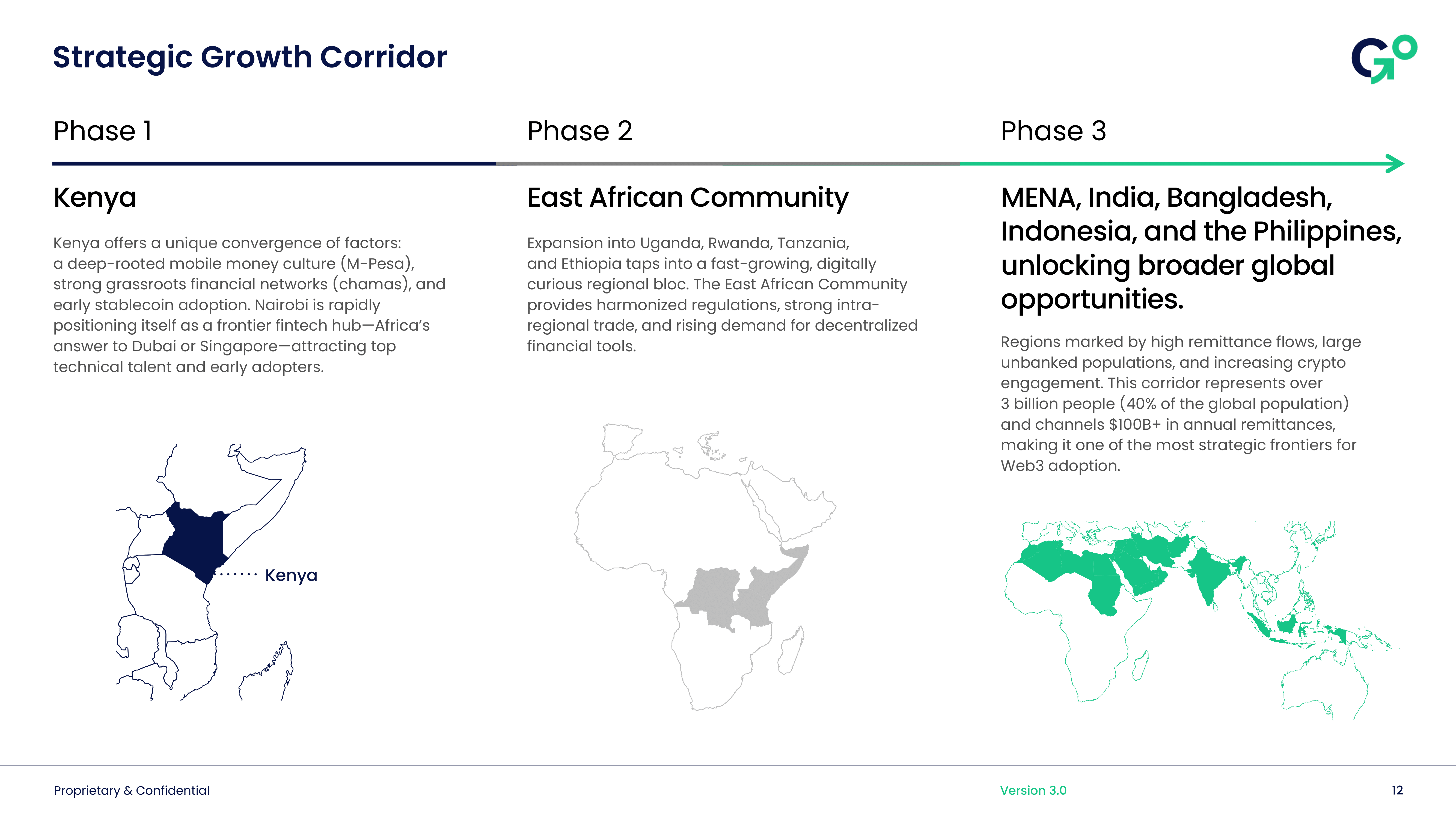

Phase 2: East African Community

Regional Expansion

Expansion into Uganda, Rwanda, Tanzania, and Ethiopia taps into a fast-growing, digitally curious regional bloc.

East African Community Benefits

- Harmonized regulations across member states

- Strong intra-regional trade and economic integration

- Rising demand for decentralized financial tools

- Cultural similarities and shared languages

Market Characteristics

- Fast-growing economies with increasing digital adoption

- Young populations eager for financial innovation

- Mobile-first users with smartphone penetration

- Cross-border trade and remittance needs

Strategic Implementation

- Regulatory compliance across all EAC countries

- Local partnerships with financial institutions

- Agent network expansion in key urban centers

- Cultural adaptation for local market needs

Phase 3: Global Opportunities

Target Regions

MENA, India, Bangladesh, Indonesia, and the Philippines, unlocking broader global opportunities.

Market Characteristics

- High remittance flows ($100B+ annually)

- Large unbanked populations seeking financial inclusion

- Increasing crypto engagement and adoption

- Mobile-first economies with digital infrastructure

Strategic Importance

- Over 3 billion people (40% of the global population)

- $100B+ in annual remittances flowing through the corridor

- One of the most strategic frontiers for Web3 adoption

- Cultural and economic connections to East Africa

Implementation Strategy

- Remittance partnerships with major stablecoin providers

- Regional exchange integrations for liquidity

- Government licensing for stablecoin clearing

- Local agent networks for user onboarding

Corridor Advantages

Economic Integration

- Strong trade relationships between regions

- Cultural connections through diaspora communities

- Shared financial needs and pain points

- Complementary economies and resources

Regulatory Synergies

- Similar regulatory approaches to fintech

- Cross-border cooperation on financial services

- Harmonized standards for digital assets

- Shared compliance frameworks

Technology Transfer

- Best practices sharing across markets

- Innovation diffusion from developed to emerging markets

- Local adaptation of global solutions

- Community-driven development approaches

Market Entry Strategy

Phase 1: Foundation (Kenya)

- Build core platform and user base

- Establish regulatory compliance

- Develop agent networks and partnerships

- Prove product-market fit in local market

Phase 2: Regional Expansion (EAC)

- Scale proven model to neighboring countries

- Adapt to local market conditions

- Build regional partnerships and networks

- Establish regulatory presence in new markets

Phase 3: Global Scale (Indian Ocean Corridor)

- Expand to high-potential markets

- Build cross-border infrastructure

- Establish global partnerships

- Scale agent networks internationally

Success Metrics

Phase 1 Targets (Kenya)

- 10K active wallets in first 6 months

- $1M+ processed in transaction volume

- 100+ agent locations across major cities

- Regulatory approval for all services

Phase 2 Targets (EAC)

- 100K active users across region

- $10M+ processed in transaction volume

- 1000+ agent locations across countries

- 3+ countries fully operational

Phase 3 Targets (Global)

- 1M+ active users across corridor

- $100M+ processed in transaction volume

- 10,000+ agent locations globally

- 10+ countries with full operations

Risk Mitigation

Regulatory Risks

- Proactive compliance with local regulations

- Government relations and policy engagement

- Legal framework development and adaptation

- Regulatory sandbox participation

Market Risks

- Local market research and adaptation

- Cultural sensitivity in product design

- Competitive analysis and differentiation

- User education and adoption strategies

Operational Risks

- Local talent development and retention

- Infrastructure scaling and reliability

- Security and compliance maintenance

- Partnership management and oversight

Long-term Vision

Global Financial Infrastructure

- First licensed crypto-fiat bridge across Africa-Asia

- Merchant ecosystems for real-world usage

- RWA lending for real-world asset tokenization

- DeFi chama DAOs for community governance

Economic Impact

- $1B+ processed volume across the corridor

- Entrenched corridor dominance in financial services

- Financial inclusion for millions of users

- Economic empowerment through community finance

The Strategic Growth Corridor represents GoChapaa's path to becoming the leading financial platform for emerging markets, connecting 3+ billion people through innovative, community-driven financial services.