Go-To-Market Strategy

GoChapaa's go-to-market strategy is designed to leverage existing financial networks and community structures while building sustainable, scalable growth across emerging markets. Our approach prioritizes local partnerships, community engagement, and regulatory compliance.

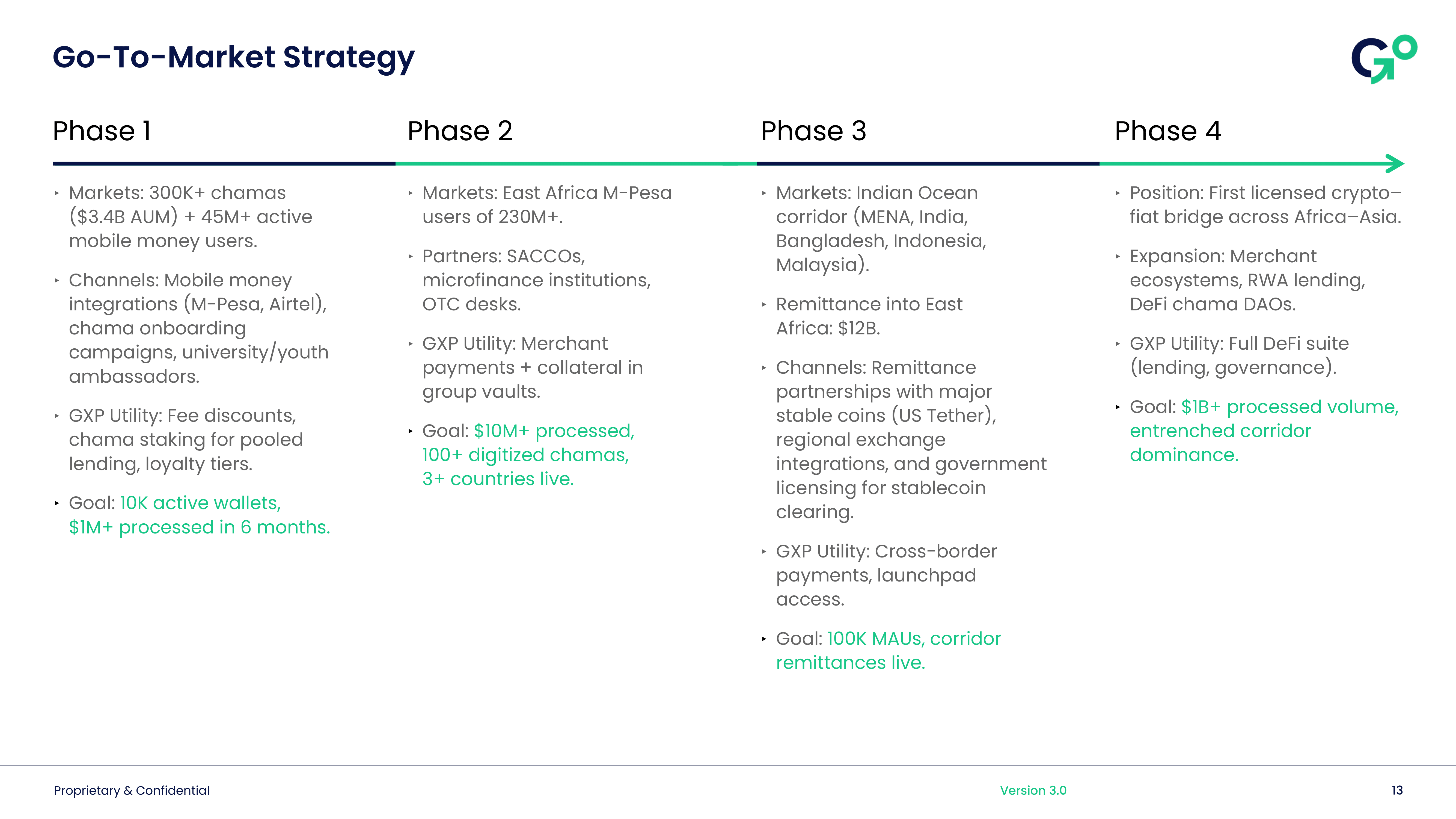

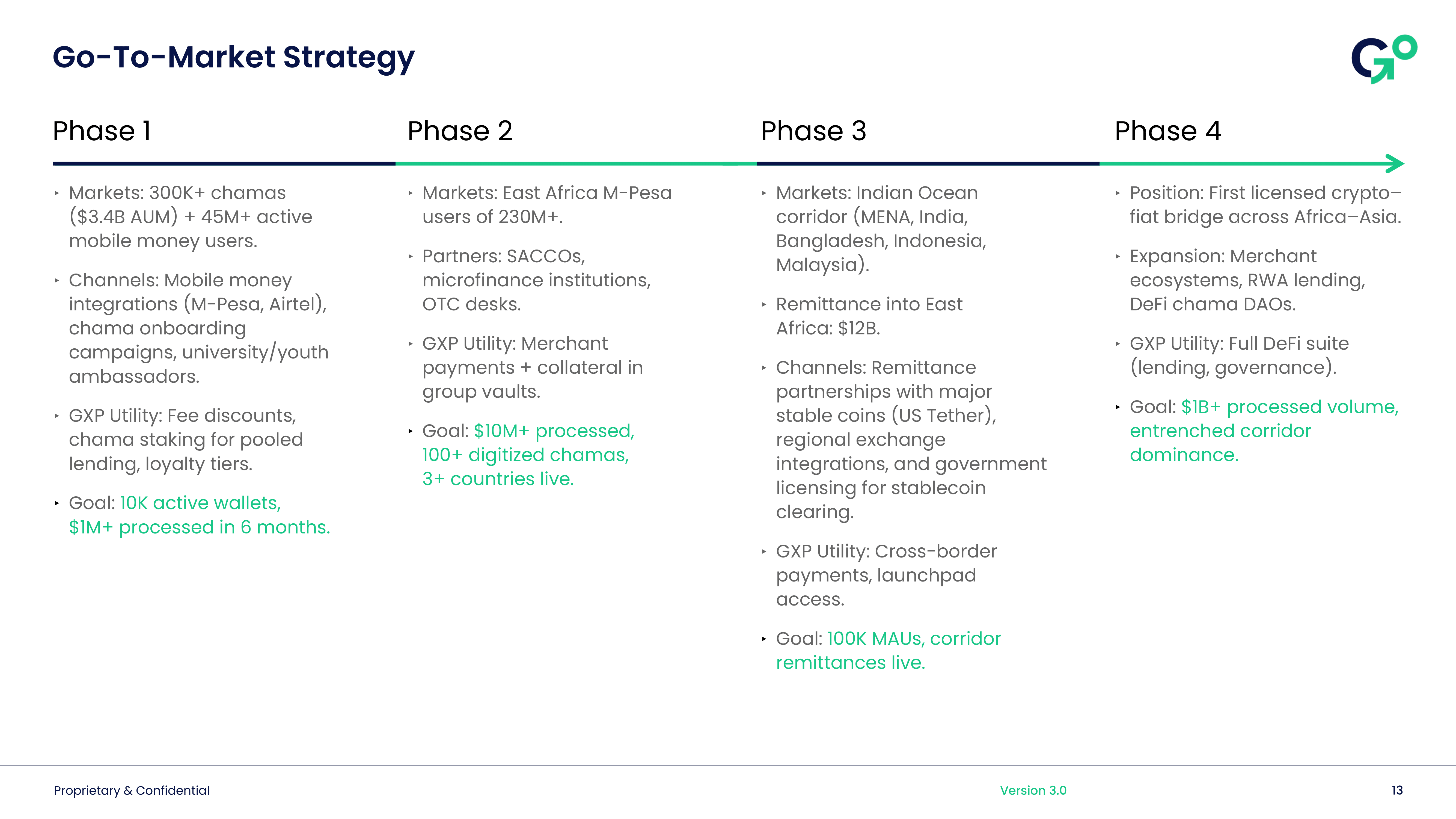

Phase 1: Initial Launch & User Acquisition

Target Markets

- 300K+ chamas managing $3.4B+ in assets

- 45M+ active mobile money users in Kenya

- University students and young professionals

- Freelancers and gig economy workers

Distribution Channels

- Mobile money integrations (M-Pesa, Airtel Money)

- Chama onboarding campaigns through community leaders

- University/youth ambassadors on campuses

- Agent networks for physical presence and support

$GXP Utility

- Fee discounts for early adopters

- Chama staking for pooled lending opportunities

- Loyalty tiers with increasing benefits

- Community rewards for participation

Success Metrics

- 10K active wallets in first 6 months

- $1M+ processed in transaction volume

- 100+ chamas onboarded to platform

- 50+ agent locations across major cities

Phase 2: East Africa Expansion & Merchant Integration

Target Markets

- East Africa M-Pesa users of 230M+

- SACCOs (Savings and Credit Co-operative Societies)

- Microfinance institutions and lenders

- OTC desks and exchange operators

Strategic Partnerships

- SACCOs for community finance integration

- Microfinance institutions for lending partnerships

- OTC desks for liquidity provision

- Mobile money providers for seamless integration

$GXP Utility

- Merchant payments using $GXP tokens

- Collateral in group vaults for lending

- Fee reductions for high-volume users

- Governance rights for platform decisions

Success Metrics

- $10M+ processed in transaction volume

- 100+ digitized chamas across region

- 3+ countries fully operational

- 500+ merchant locations accepting $GXP

Phase 3: Indian Ocean Corridor & Remittance Focus

Target Markets

- Indian Ocean corridor (MENA, India, Bangladesh, Indonesia, Malaysia)

- $12B+ remittance flows into East Africa

- Diaspora communities sending money home

- Cross-border workers and freelancers

Strategic Channels

- Remittance partnerships with major stablecoin providers (US Tether)

- Regional exchange integrations for liquidity

- Government licensing for stablecoin clearing

- Cross-border agent networks for local presence

$GXP Utility

- Cross-border payments with reduced fees

- Launchpad access for new projects

- Staking rewards for long-term holders

- Governance participation in platform decisions

Success Metrics

- 100K MAUs (Monthly Active Users)

- Corridor remittances fully operational

- 10+ countries with agent networks

- $50M+ in cross-border transaction volume

Phase 4: Crypto-Fiat Bridge & DeFi Dominance

Market Position

- First licensed crypto-fiat bridge across Africa-Asia

- Regulatory compliance across all operating jurisdictions

- Institutional partnerships with major financial players

- Technology leadership in emerging market fintech

Expansion Areas

- Merchant ecosystems for real-world usage

- RWA lending (Real World Asset lending)

- DeFi chama DAOs for community governance

- Institutional services for larger clients

$GXP Utility

- Full DeFi suite (lending, governance, yield farming)

- Institutional access to premium services

- Cross-chain compatibility for global usage

- Advanced features for power users

Success Metrics

- $1B+ processed volume across platform

- Entrenched corridor dominance in financial services

- 1M+ active users globally

- 50+ countries with operational presence

Community-Led Growth Strategy

Interactive Community Engagement

- Growth driven by interactive community - Telegram and Twitter

- Not paid ads - organic growth through community trust

- Trusted and approved locally by community leaders

- User-generated content and testimonials

Creator Partnerships

- Active creator partnerships with top creators like Nviiri Sande

- Emerging talent collaboration and support

- Content creation for user education

- Community building through influencer networks

Campus Integration

- Embedded into campus ecosystems and growing together

- Young talents in finance, CS, and dev clubs

- University partnerships for research and development

- Student ambassador programs for growth

Local Agent Networks

- Local agents activate regions and support users

- Manage onboarding and user education

- Physical presence in communities

- Trust building through face-to-face interactions

Community Campaigns

- Community campaigns and demo days instead of billboard ads

- Local events and meetups

- Educational workshops on financial literacy

- User testimonials and success stories

Market Entry Tactics

Regulatory First Approach

- Proactive compliance with local regulations

- Government relations and policy engagement

- Regulatory sandbox participation for innovation

- Transparent operations for regulatory trust

Partnership Strategy

- Strategic partnerships with local financial institutions

- Technology partnerships with infrastructure providers

- Community partnerships with local organizations

- Government partnerships for policy development

User Education

- Financial literacy programs for new users

- Technology education on crypto and DeFi

- Community workshops on platform features

- Ongoing support through agent networks

Product Localization

- Language support for local languages

- Cultural adaptation of user interface

- Local payment methods integration

- Community-specific features and services

Success Measurement

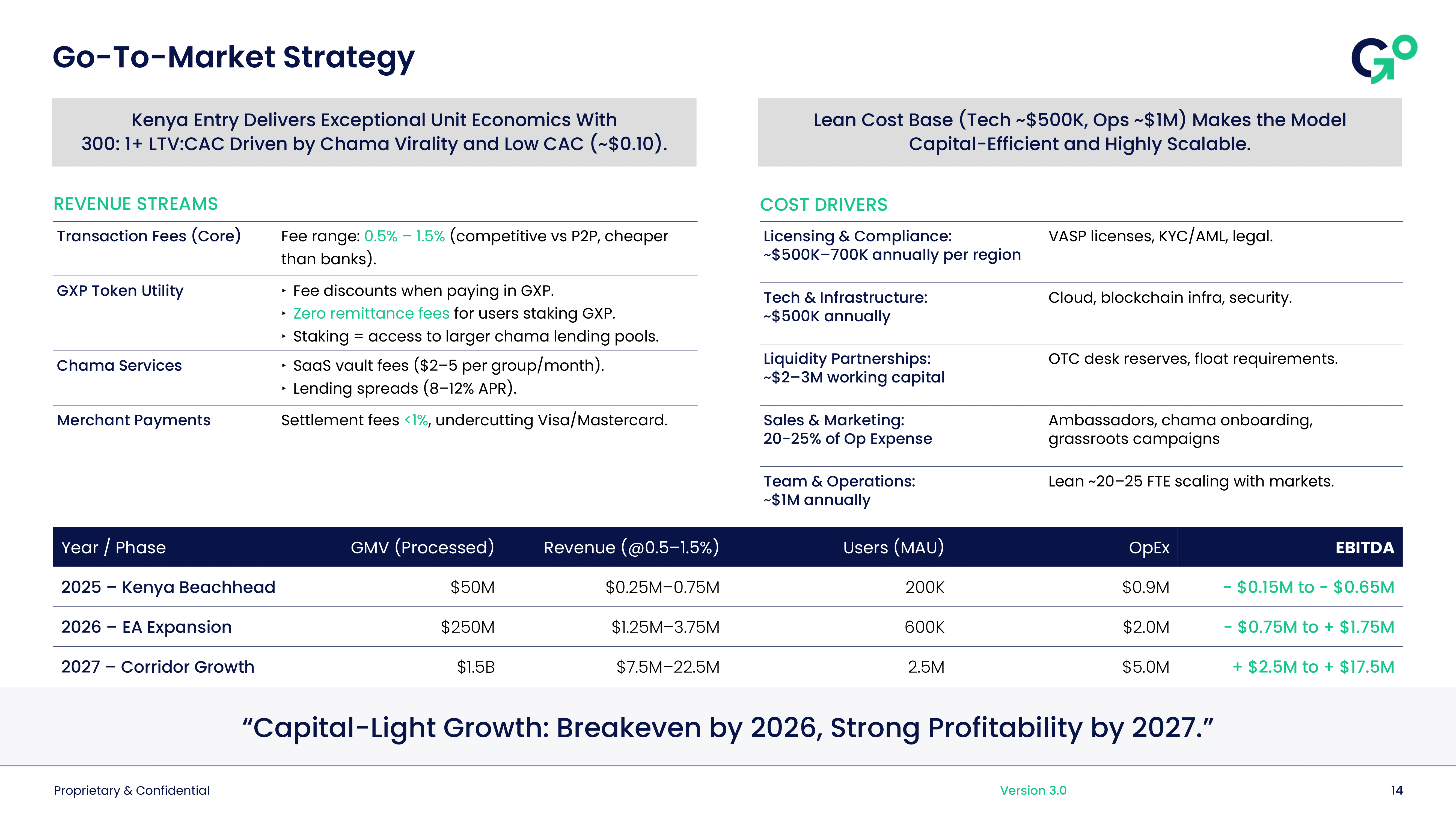

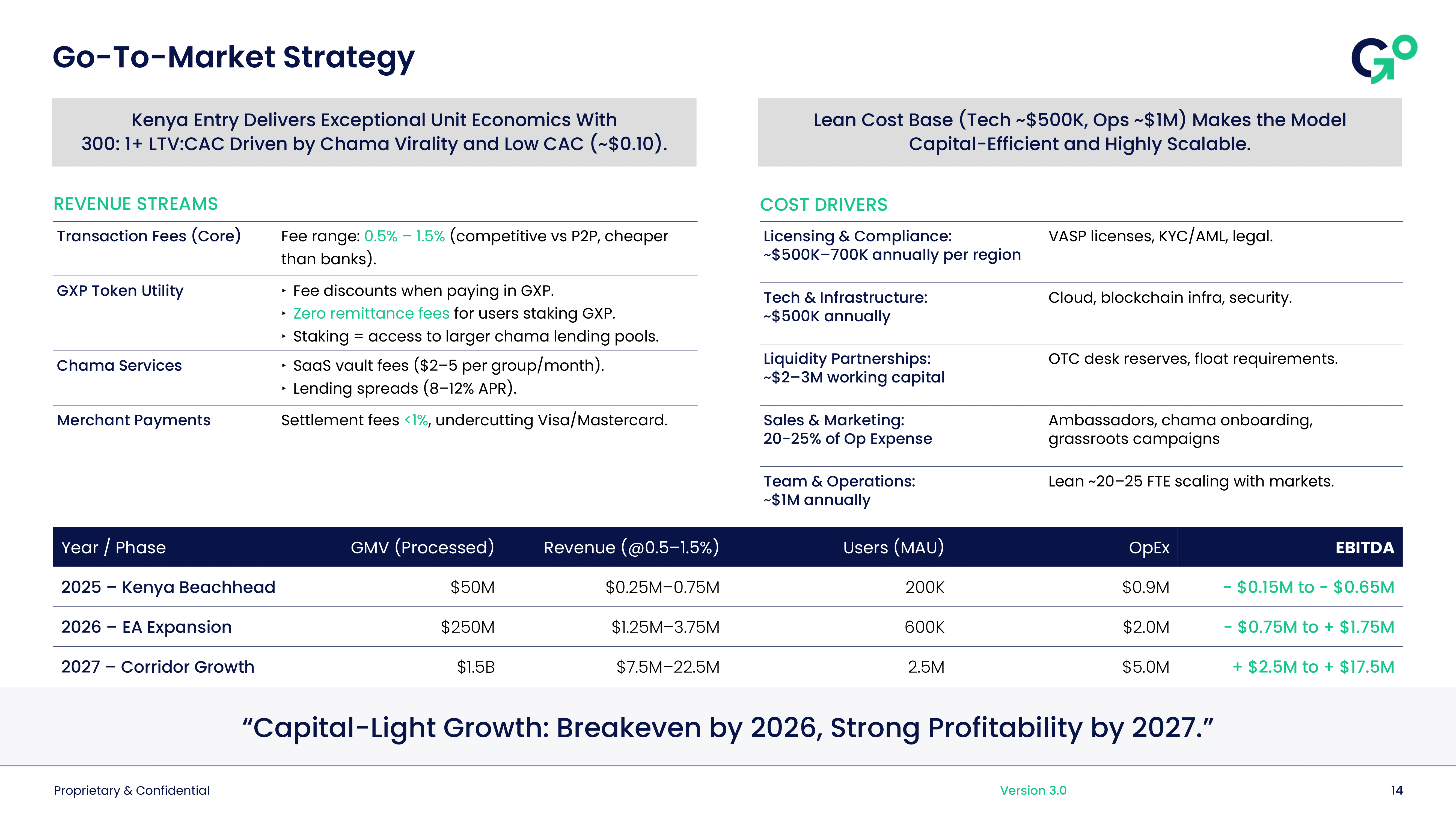

Key Performance Indicators

- User acquisition and retention rates

- Transaction volume and frequency

- Agent network growth and performance

- Regulatory compliance and approvals

Financial Metrics

- Revenue growth and profitability

- Cost per acquisition and lifetime value

- Market share in target segments

- Return on investment for partnerships

Community Metrics

- Community engagement and participation

- User satisfaction and net promoter score

- Agent performance and retention

- Regulatory approval and compliance

GoChapaa's go-to-market strategy combines community-driven growth with regulatory compliance and strategic partnerships to build sustainable, scalable financial services across emerging markets.